401k max contribution 2021 calculator

Step 1 Determine the initial balance of the account if any and also there will be a fixed periodical amount that will be invested in the 401 Contribution which would be. Your employer needs to offer a 401k plan.

401k Contribution Calculator Step By Step Guide With Examples

The 401k contribution limit for 2022 is 20500.

. Anyone age 50 or over is eligible for an additional catch-up contribution of. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged. For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021.

Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into an Individual 401k SEP IRA Defined Benefit Plan or. This calculator assumes that your return is compounded annually and your deposits are made monthly. An employee contribution of for An.

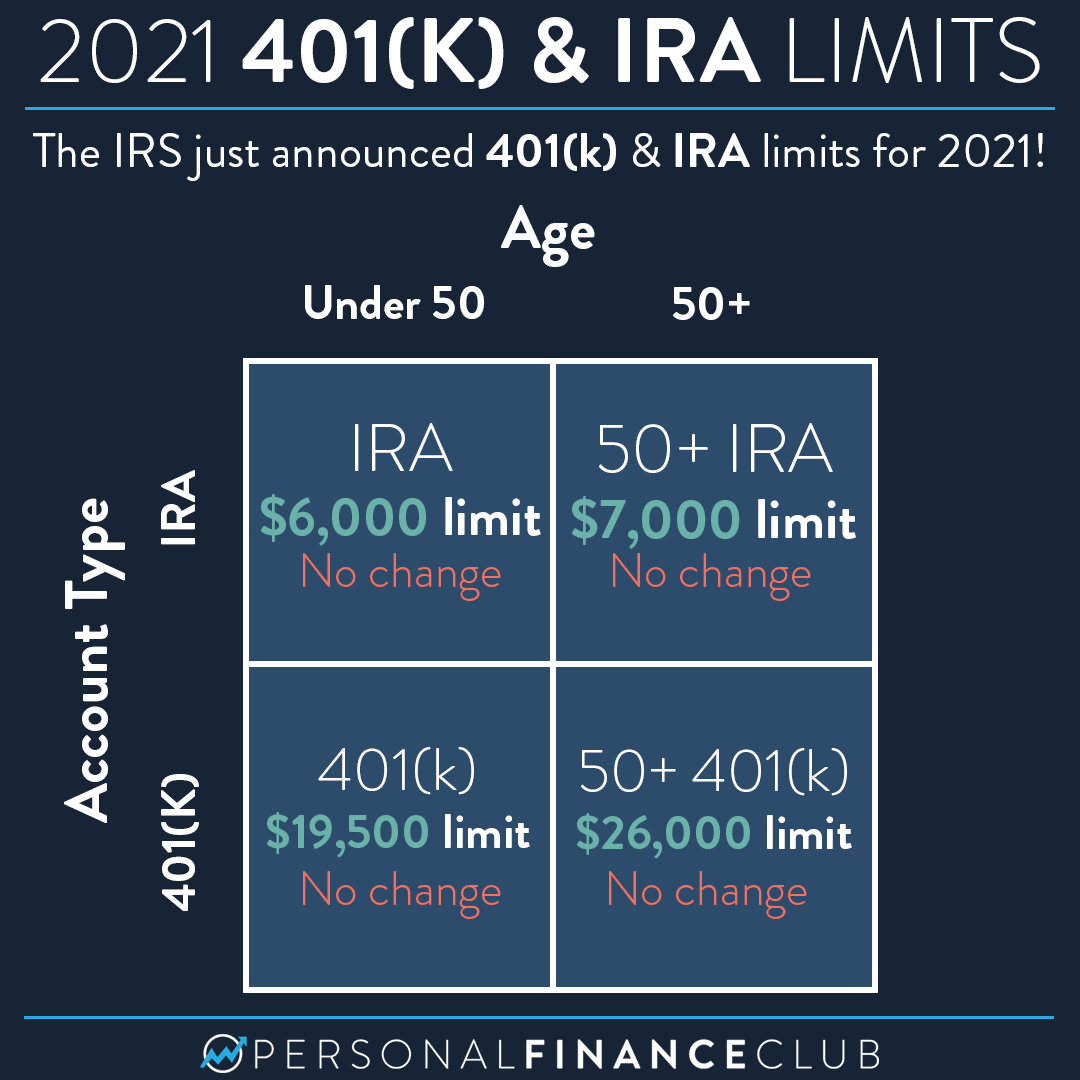

Employees 50 or over can make an additional catch-up contribution of 6500. The maximum limit went from 57000 in 2020 to 58000 in 2021. Employees can contribute up to 19500 to their 401 k plan for 2021 and 20500 for 2022.

This calculator assumes that your return is compounded annually and your deposits are made monthly. For 2021 the 401k contribution limit is 19500 in salary deferrals. You may contribute additional elective.

Contribution limits to a Solo 401k are very high. This is up from 57000 and 63500 in 2020. Supplementing your 401k or IRA with cash value life insurance can help.

Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing a separate return and you lived with your spouse at any time during the. The maximum contribution amount that may qualify for the credit is 2000 4000 if married filing jointly making the maximum credit 1000 2000 if married filing. Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there.

In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can be contributed to a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older. The annual rate of return for your 401 k account. Specifically you are allowed to make.

Individual 401 k Contribution Comparison. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. If permitted by the 401 k plan participants age 50 or over at the end of the calendar year can also make catch-up contributions.

For 2021 the max is 58000 and 64500 if you are 50 years old or older. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks. We use the current maximum contributions 18000 in 2015 and 53000 including company. These are the IRS rules.

The actual rate of return is largely. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. 401k Contribution Calculator Step By Step Guide With Examples Ad Compare 2022s Best Gold.

After Tax Contributions 2021 Blakely Walters

How Much Should I Have Saved In My 401k By Age

401k Contribution Calculator Step By Step Guide With Examples

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Employer 401 K Maximum Contribution Limit 2021 38 500

Solo 401k Contribution Limits And Types

The Maximum 401k Contribution Limit Financial Samurai

Solo 401k Contribution Limits And Types

Who Should Make After Tax 401 K Contributions Smartasset

401 K Plan What Is A 401 K And How Does It Work

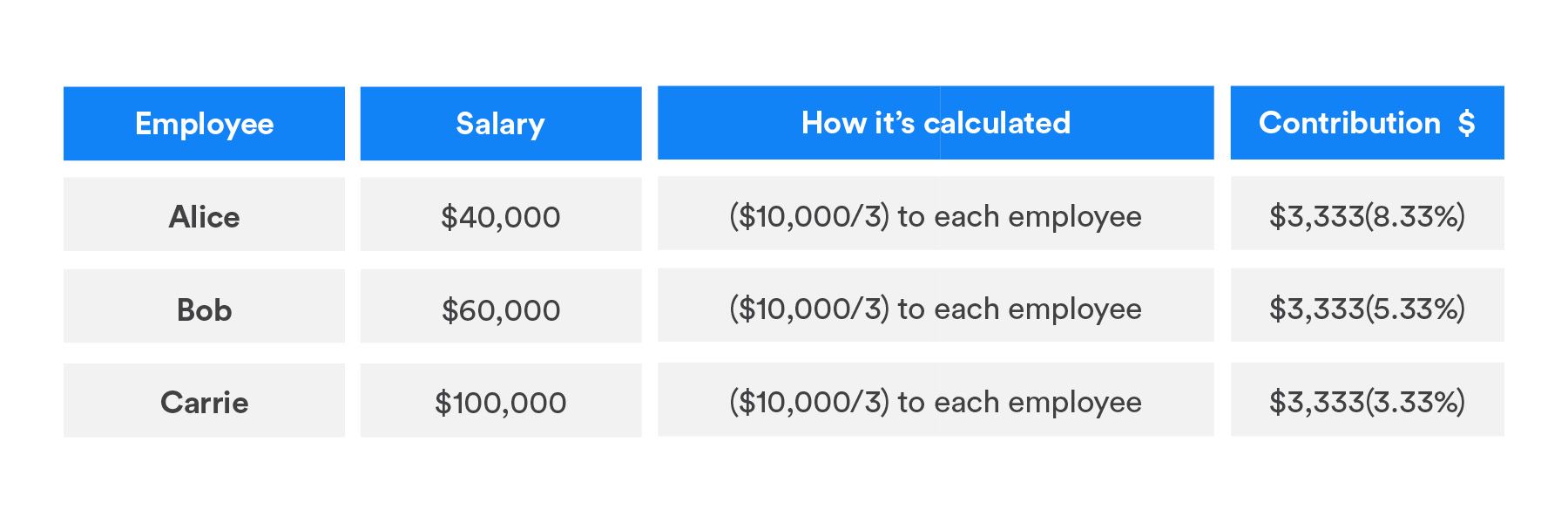

401 K Profit Sharing Plans How They Work For Everyone

Free 401k Calculator For Excel Calculate Your 401k Savings

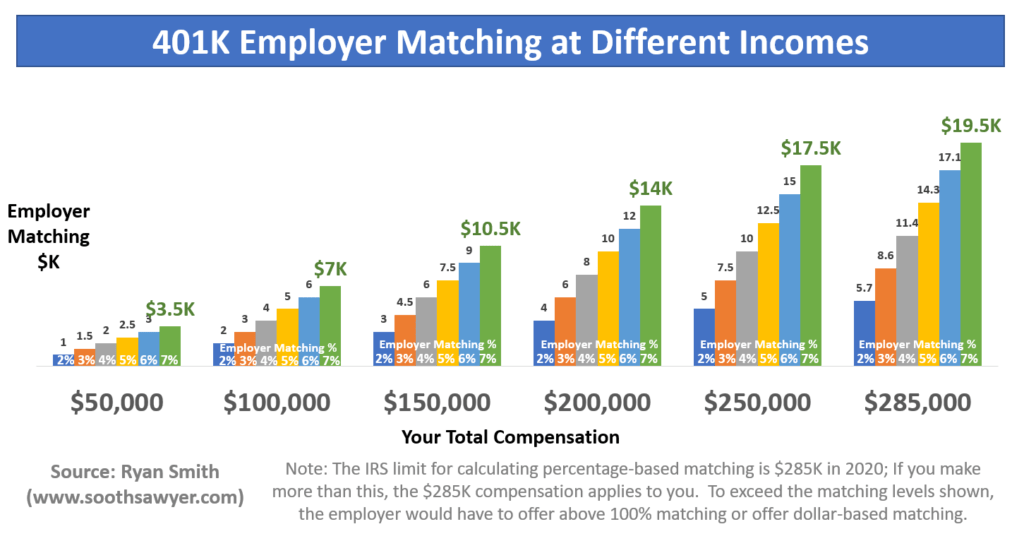

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

2021 Retirement Contribution Limits Ubiquity

The Maximum 401 K Contribution Limit For 2021